S pecialist Inheritance Tax Planning Solicitors

pecialist Inheritance Tax Planning Solicitors

Lifetime Estate Planning Experts

Planning for the future is very important for everyone – but often we leave things too late. In addition to advising on inheritance tax planning issues, we can help you with income tax and capital gains tax. Our expert estate planning lawyers can help complete your self assessment tax return and ensure that you claim all the appropriate exemptions and reliefs.

Are you thinking of getting advice on lifetime planning? Our private client team can help you with your estate and inheritance tax planning wherever you live – both locally throughout Wiltshire, Hampshire and Dorset and nationwide from our offices in Salisbury, Fordingbridge, Andover and Amesbury.

Inheritance Tax Update – November 2024

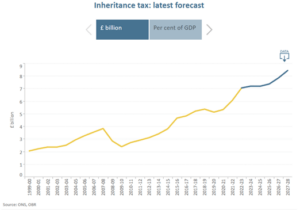

The 1st budget from the new Labour Chancellor extended the current freeze in the IHT threshold for another 2 years until 2030, despite recent high inflation. That, means UK taxpayers will be paying more and more inheritance tax. At the current rate of tax collection, according to figures released in April 2024 by HM Revenue and Customs, Inheritance Tax raised a record £7.5 billion in 2023/4, way higher than the previous all-time high of £7.1bn in 2022/23. And according to the Chancellor herself, those changes in the October 2024 budget will increase the total of IHT raised by more than £2bn.

And following those IHT changes made in the October 2024 budget, economists at the Institute for Fiscal Studies think tank predict that a remarkable 55% more estates could be liable to pay inheritance tax by 2030 compared with 2023/4.

Don’t take any chances – contact our team for your specialist inheritance tax planning advice.

Our tax planning expertise

The most experienced member of our tax team is solicitor, Elizabeth Webbe. Elizabeth is a Full Member of STEP (the Society of Trust and Estate Practitioners), the leading global professional organisation of accountants and lawyers specialising in wealth management. She can help you safeguard your family wealth creating a lasting financial legacy through bespoke succession planning.

What is more, as part of our specialist team, we have an in-house tax accountant – and we work closely alongside a number of other local professionals including trusted independent financial advisers.

For a FREE Inheritance tax saving and estate planning consultation , simply call our Lawyers on FREEPHONE 0800 1404544 or one of our local office numbers [see below] for a no strings attached conversation.

How Bonallack & Bishop can help you with inheritance tax planning

• Tax planning. Minimising the liability to inheritance tax, capital gains tax and income tax both in your lifetime and on your death.

• Planning to pass the wealth down the generations

• Family protection

• Cross border matters. Elizabeth Webbe, a highly senior member of a team has extensive experience with clients with assets overseas, or who are not UK domiciled and/ or who are in a relationship where one partner is home grown and one not. Elizabeth ensures her tax solutions do not impact adversely on any home territory tax planning.

• Our solutions? There are a wealth of structures and opportunities here. They include strategic gifting, various types of trusts, complex wills, collapsing trusts, advising on existing and/or future corporate or partnership structures, succession strategies from a family wealth perspective and pension scheme devolution.

Why Inheritance Tax Planning is becoming increasingly important

Recent financial figures from the government says it all. As indicated above, HMRC reported in April 25, 2023 that receipts from inheritance tax from April 2023 to March 2024 reached £7.5 billion, a significant increase up from just £6.1 billion in 2021/22. What’s more, forecasts from the Office for Budget Responsibility (OBR) suggest IHT receipts will reach as much as £8.4 billion by 2027/28 – and you can add in an additional £2 billion following the changes in the October 2024 budget.

No wonder that IHT is now starting to be described as a ‘mainstream tax on ordinary people’.

But this is nothing new. The last 10 years have shown a consistently upward trend in the amount of inheritance tax paid. And that trend looks like continuing.

Why? The nil-rate inheritance tax band (below which no tax is paid) has remained frozen at £325,000 since 2009. Even before inflation started really rising in 2022, since 2009 the average house price has increased by 67% and inflation by 45%.

And the fact that the that following the Chancellor’s latest budget, the £325,000 nil rate tax band(see below) is due to remain at that level until at least 2030 means more and more people will be hit by inheritance tax. And with the average asking price for a house in the UK at £366,247 (in April 2023 according to Rightmove), inheritance tax is not just for the rich these days.

It’s amazing how many people have failed to take any serious wealth planning advice. For example, according to 2023 research conducted by Investec Wealth & Investment, just 44% of those with assets over £1 million have taken advice on inheritance tax planning advice.

Not having proper inheritance tax planning is costing far too many people a significant percentage of their inheritance. To make sure you are not one of them – get in touch with our wealth planning team today.

Do You Have an Up To Date Will?

When it comes to Inheritance Tax Planning, having an up-to-date will that reflects your current circumstances is absolutely key. So, if you are not sure of whether or not you need to update your Will, then you can take advantage of Bonallack & Bishop’s free review offer.

So just call us to book in your FREE Wills Review appointment – with no obligation or strings attached

Inheritance Tax Planning and Your Will – Can I Save Money?

On death, your assets are subject to Inheritance Tax. Despite recent tax changes, Inheritance Tax is still a real issue for many people and following changes introduced by the latest budget, there are still opportunities for significant savings to be made in planning for the future and protecting family assets later in life from what can prove to be considerable care costs.

However, it is remarkable how much tax people are paying unnecessarily in the absence of properly prepared Will and tax planning.

The October 2024 budget confirmed that the IHT nil rate band will remain at £325,000. This 0% rate tax is known as the nil band rate. The Chancellor also indicated that inheritance tax thresholds would be frozen at these levels until at least 2030.

Changes originally introduced by the Autumn 2007 budget created the ability to increase the nil rate band on the survivors estate by the unused proportion of the nil rate band of the first deceased of a married couple. If the first deceased left their entire estate to the survivor then this may lead to a nil rate band of £650,000 to apply to the survivors estate under current rules.

Carrying forward an unused exemption is not granted automatically; it must be claimed. Such claims can become complicated where the first to die passed away many years ago, when another tax regime applied such as estate duty. Our expert inheritance solicitors can provide specialist advice to ensure that the maximum amount available is claimed.

Click here to read more about making a will

Inheritance Tax planning – 3 important points you should consider.

With IHT no longer just for the rich, our specialist Inheritance Solicitors strongly advise you to consider taking legal advice, and to start your estate planning as early as possible – and keep it under review as the tax situation changes. In particular our team use a variety of strategies including

- Transferring assets to your spouse so your estates are about equal

- Transferring away surplus assets either by gift or transfer into trust

- Consider making the proceeds of any Life Assurance policies or pensions you may have payable directly to your spouse and children to keep the value of the policy from falling into your estate for tax purposes, or writing them into a feasible trust for the whole family.

What will form part of my estate and be subject to inheritance tax?

It’s surprisingly common for people to incorrectly estimate the value of their estate. There are broadly 3 types of property which are potentially liable for inheritance tax:

- the value of property you owned when you pass

- any gifts you made, which includes both cash and other items of value, in the 7 years prior to your death

- the value of any trusts where you had a beneficial interest#

- from 6 April 2027 IHT may will also be charged on most unused pension funds and death benefits included in the value of your estate – as announced in the October 2024 budget

What is the Great Wealth Transfer?

The Great Wealth Transfer is really important. In short, it refers to the enormous amount of wealth that will be passing from Baby Boomer generation to their Generation X and Generation Y/Millennial children between now and 2050..

How much? It really is a big figure. Somewhere in the region of £5.5 trillion (no that’s not a misprint!). That’s because Baby Boomers hold an estimated 80% of the U.K.’s private wealth.

And worldwide the figure is even bigger, as you would expect – around £68 trillion is expected to pass down through the generations.

And this money isn’t just held by a small number of Baby Boomers -the phrase given to those born in the UK between born between 1946 and 1964.

A recent survey, carried out by will writing software business, Arken, of over 250 organisations in the estate planning industry, found that they reported 31% of the potential beneficiaries expected to inherit somewhere between £200k and £400K, with a remarkable 34% estimating that figure was approximately £400 to £500k – or more.

If you’re a Baby Boomer with substantial assets – or even just a mortgage free average house- don’t take chances on leaving your children to pay unnecessary inheritance tax. Let us put your mind at rest. Contact our highly specialist wealth planning team on FREEPHONE 0800 1404544 for an initial no strings attached phone call to find out where you stand.

Are there tax advantages in making charitable gifts in my will?

Absolutely – and they really are substantial advantages. Did you know that gifts to charity in your will are exempt from 40% IHT? And what’s more, if you give over 10% of your estate to a charity, you actually receive the benefit of a discounted 36% tax rate across the whole of your estate.

And there are 3 ways you can gift property to a charity:

- you can identify a fixed amount of money to be paid over

- you can give a physical item, land, property or shares – although when you do leave a legacy in this way, you may find that charity will ask the executors of your estate to sell the gift on its behalf (it is also worth noting that your executors will not have to pay Capital Gains Tax on any land, property or shares you leave to a charity – potentially another significant tax saving).

- you can leave what is known as “the residue” of your estate. That is what is left after all the other gifts have been paid out

Having these kind of tax planning bonuses explained to you is another reason to get your will drafted professionally and reviewed on a regular basis by an experienced will writing solicitor.

Lasting Power of Attorney

The Lasting Power of Attorney, or LPA, is now the primary way to give a trusted person the authority to to deal with your affairs if you become incapacitated. It replaced the earlier Enduring Power of Attorney, or EPA, when it was introduced in 2007 – although EPAs made prior to that date remain valid. It is simply that EPA’s can no longer be created.

The Finance LPA can operate both before and after a person becomes incapable of managing their own affairs. It is also possible to make a LPA setting out of your wishes regarding your Personal Welfare. Our Solicitors recommend that everyone considers making an LPA.

Click here to find out more about a Lasting Power of Attorney and the Difference Between a Lasting and Enduring Power of Attorney

Appointing a guardian

If you have children under 18, you should consider appointing guardians to take care of their day to day care if you die while they remain young. Even if they have ‘godparents’, we all know that the choice of godparent is sometimes an emotional decision made at a specific time and you may not want them to bring up your children.

Appointment of Guardians is usually done while making your Will. It gives you control over the identity of the people or person you want to bring up your children.

Trusts

These are funds which contains assets that are controlled by you and/or a nominated third party for the benefit of a specific individual(s). They are governed by complex legal regulations and separate tax rules. A Trust can be created at any time during your lifetime to become operative immediately, or not until your death.

Our specialist team regularly deal both with the creation of new trusts and administration of existing trusts.

If you want to know more about what a Revocable or Irrevocable Trust can do for you, click here to read more about how to create a Trust or here to find out more about our specialist professional trustee solicitors and how they can help you administer existing trusts .

Living wills and Advance Directives

An Advance Directive can record your wishes with respect to certain medical procedures that would or will not be acceptable to you. They can only be employed if you lose mental capacity (‘advanced directive’). Alternatively, a Living Will can record your beliefs on such procedures for the family to consider if a difficult decision with regard to your health has to be made (‘non-advanced directive’).

Click here to read more about making a living will

Long Term Care Planning

It is hard to imagine not being able to live in your own home and look after yourself. Planning at the right time to make sure any care you may need in the future is covered without having to sell your home is important for some people.

Our team includes solicitors specialising in care home fees planning who can help you find out more about the rules about paying for a permanent care home place and we work closely with independent financial advisors who can discuss with you your options concerning wealth protection and long term care funding.

FAQ’s

Can a solicitor help with inheritance tax?

In a word, yes, solicitors can help with Inheritance Tax. An experienced Inheritance Tax planning solicitor will have a range of options that can limit the amount of tax payable on an estate. If you ask us to help you, we will take the time to understand your situation and then advise you of the most efficient methods of reducing tax liabilities.

We will suggest the best ways to minimise or even eliminate Inheritance Tax on your estate. At the same time, we will ensure that your assets will be passed on to your chosen beneficiaries in the way you want when the time comes.

How much can you inherit from your parents without paying taxes in the UK?

Everyone has an Inheritance Tax threshold of £325,000. This means no tax is payable on the first £325,000 left in someone’s estate.

In addition, no Inheritance Tax is payable on anything left to your spouse or civil partner. Any unused portion of your £325,000 allowance can be transferred to their estate when then die. This gives their estate a potential threshold of £650,000, meaning that Inheritance Tax is only payable on the portion of the estate above £650,000.

If you leave a property to your children or grandchildren, there is an additional allowance of £175,000 for each spouse or civil partner. This makes a total potential Inheritance Tax threshold of £1 million for a married couple.

Do I have to inform HMRC if I inherit money?

No, you do not have to tell HMRC if you inherit money. After a death, the deceased’s executor or administrator will pay any tax owed by the deceased or their estate.

If you inherit money you do not need to tell HMRC but you will need to report any income or dividends that you receive in each tax year.