The Forces Help To Buy Loan Scheme – What is It?

The Forces Help To Buy Loan Scheme – What is It?

LATEST MoD UPDATE – The Forces Help to Buy scheme has been made permanent, with effect from 1 January 2023.

This interest-free Armed Forces loan is the new scheme for supporting serving UK Forces personnel to buy their own home – or move house.

It was launched on April 1, 2014 and Government funding is generous – by the end of March 2023, 2019 the MoD had made over £452 million to over 29,000 armed forces personnel to provide for these new military home loans. What’s more, the MoD has confirmed that this new scheme is now going to remain in force permanently.

It broadly replaces the two previous long-running forces home loan schemes – LSAP [Long Service Advance of Pay] which has been frozen with no new loans being offered, and AFHOS [the Armed Forces Home Ownership Scheme] which has been shut down entirely. The FHTB scheme is considerably more generous than either of its predecessors.

The scheme broadly offers a loan of up to half of their salary [with a maximum loan of £25K], to those serving in either the British Army, Royal Navy and RAF.

It’s the ideal way to get onto the property ladder and remains extremely popular. In a recent quick poll taken by AFF (the Army Families Federation), 69% of families said they were planning to use the scheme in 2019.

Forces Help To Buy – what type of property does it cover?

To be eligible for one of these new loans, your property needs to be;

1. Your first home –ie for the immediate occupation or your immediate family. It’s okay if you are single and unable to occupy the property in week provided you usually live there at weekends and when on leave.

2. A residential property –FHTB doesn’t cover commercial property

3. Situated in either in UK [including the Isle of Man and the Channel Islands] . However there is one exception –if one or both your parents carries an Irish passport, you can use FHTB to buy a property in the Republic of Ireland]

4. A “mortgagable property” –the kind of property on which you could get a regular mortgage. This means that your chosen property must be of standard construction and in particular you’re not able to use Forces Help to Buy to purchase a mobile home, houseboat or caravan

5. You cannot use the scheme to pay for furnishing your house. The scheme is limited to paying towards the purchase price and deposit only.

Who is eligible for an interest free loan?

To qualify for the Forces Help to Buy scheme, you will need to satisfy the following;

- you are in regular service with a minimum of six months left to serve

- you cannot have owned, in the last 12 months, any property within 50 miles from the new property you propose purchasing with FHTB

- for Army and RAF personnel, you need to have completed two years service from the date of enlistment and completed Phase 2 training. For Marines or Naval personnel, you need to been accepted onto the trained strength

It makes no difference whether you are single, married or have entered into a civil partnership.

How does FHTB fit in with other government Help to Buy schemes?

One really important thing to note, and this hasn’t received much publicity. Military personnel can not only get an interest-free loan up to £25K under the new Forces Help To Buy scheme – but they can also still use the Government Help to Buy schemes. Between them they could enable thousands of military families afford to finally get onto the first rung of the property ladder.

How much can I borrow under the scheme?

To find out the amount that you could receive, you should apply using JPA Form E024 at least six weeks before the purchase of your intended house is complete. The loan you could receive can be used for a number of purposes from paying for a house deposit to paying the legal fees, surveyor’s fees or the estate agents fees.

Is Forces Help To Buy available for making changes to my home?

You cannot use the loan just to enhance or expand your current house. But, if your current property is not appropriate for medical or other family reasons, then it is likely that you could get a FHTB loan.

What happens if I am then posted overseas and want to go accompanied, but I have purchased a property using FHTB?

You can keep your Forces Help to Buy loan. However, if you decide to lease your property, while the home remains let, you will need to pay interest on the amount outstanding under your loan.

Does securing a FHTB loan mean I’m guaranteed a mortgage?

Sadly no. Being awarded a loan under the Forces Help to Buy scheme ought to help your application though, so do make sure you inform the mortgage company. But you will need to apply independently for a mortgage, so there are no guarantees

Are there any Insurance Costs?

Yes. You are going to need to make a small loan protection insurance payment every month. Depending on the size of your loan, this payment is likely to be as little as £6 or £7 a month

How We Can Help You

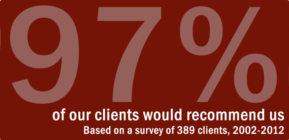

Here at Bonallack and Bishop we have huge experience over the last 30 years of representing members of HM Armed Forces.

We represent hundreds of serving and retired Forces personnel each and every year with a range of legal issues – from military divorce and court-martial to wills, military accident claims and conveyancing for property purchase originally using LSAP and AFHOS and now, the more generous FHTB loan scheme.

Our military clients include both local forces personnel from the Tidworth, Larkhill and Bulford garrisons, those based elsewhere in the UK as well as those deployed overseas, from whom we take instructions using phone, email and Zoom video or FaceTime.

We are a Forces Law firm – long-standing members of the only network of specialist military law solicitors in the UK.

Bonallack and Bishop have signed the Armed Forces Covenant

As part of our commitment to support the Armed Forces Community, we have signed up to the Armed Forces Covenant – which is a promise that those who serve or have served in the armed forces, and their families, are treated fairly.